Introducing Alkimiya Protocol

June 1, 2021

“A lot of people automatically dismiss e-currency as a lost cause because of all the companies that failed since the 1990's. I hope it's obvious it was only the centrally controlled nature of those systems that doomed them. I think this is the first time we're trying a decentralized, non-trust-based system.”

— Satoshi Nakamoto

Background

After a decade of exponential growth, the mining industry is at a crossroads.

Upfront capex grows as mining operations industrialize. A global arms race to source mining hardware intensifies, as institutional players with massive appetite and deep pockets enter the game [1]. Meanwhile, the blockspace economy is evolving. Fees as a % of total block reward are rising. Ethereum MEV foreshadows a whole new and far more complicated type of behavior that is destined to change the game forever [2].

The financial return of mining is no longer a simple linear calculation [3].

Unlike traditional commodities producers with access to massive derivative markets to offload risks, the miners and their investors bear the lion’s share of the risks. The only way to trade spot hashpower is via buying and selling machines. However, the machine market is extremely inefficient due to the difficulty of moving hardware around.

As the mining competition inevitably becomes fiercer, there is natural demand for a capital market that exists to service hashpower producers to manage risk through different phases of the mining cycle [4].

Over the years, attempts at creating hedging instruments for miners have all failed to build meaningful volume (cloud mining, machine tokens, OTC hashrate swaps, FTX hashrate index, hashrate tokens issued by a centralized entity etc.).

There are problems on both the supply side and the demand side.

On the supply side, miners who wish to sell hashrate via a cloud mining platform or a hashrate token issuer are required to ship their machines to specific facilities. It’s too onerous for miners to participate as a seller.

Most of the cloud mining / hashrate token issuers end up purchasing their own machines to secure the outstanding contracts / coins and absorb the majority of the damage when the market turns. These offerings only work in bull markets where people are willing to buy anything that moves.

On the demand side, no project seemed to be able to answer the billion-dollar question: who are the natural buyers of hashpower instruments?

The fundamental challenge of growing the demand for any hashpower instrument is the price discovery mechanism. The output of the machines is highly susceptible to a wide range of physical attributes, and at the same time its theoretical pricing mirrors a multivariate option with cross-correlated underlying parameters that change every second. Hedging with only BTC or ETH price futures / options alone can’t achieve delta-neutral [5].

This means the fair value of hashpower is extremely difficult to price [6]. As a result, the existing hashpower instruments are simply too crude in design and simultaneously too complex to evaluate.

In order to create a useful instrument for the miners, there needs to be a sustainable and consistent desire to speculate on the other side of the market.

Given that there is no natural buyer of hashpower instruments, there is no demand at scale to attract miners to participate and sell in a liquid marketplace. It might appear that such a market is impossible.

Overview of the Alkimiya Protocol

The solution? Transform hashpower into something different.

In the abstract, the reward produced by hashrate over a period of time is just a stream of cash flows. These cash flows can be in turn deconstructed and restructured into other forms of cash flow generating assets that traders and investors are already familiar with.

We are building a protocol that facilitates this flow. Alkimiya protocol has two parts:

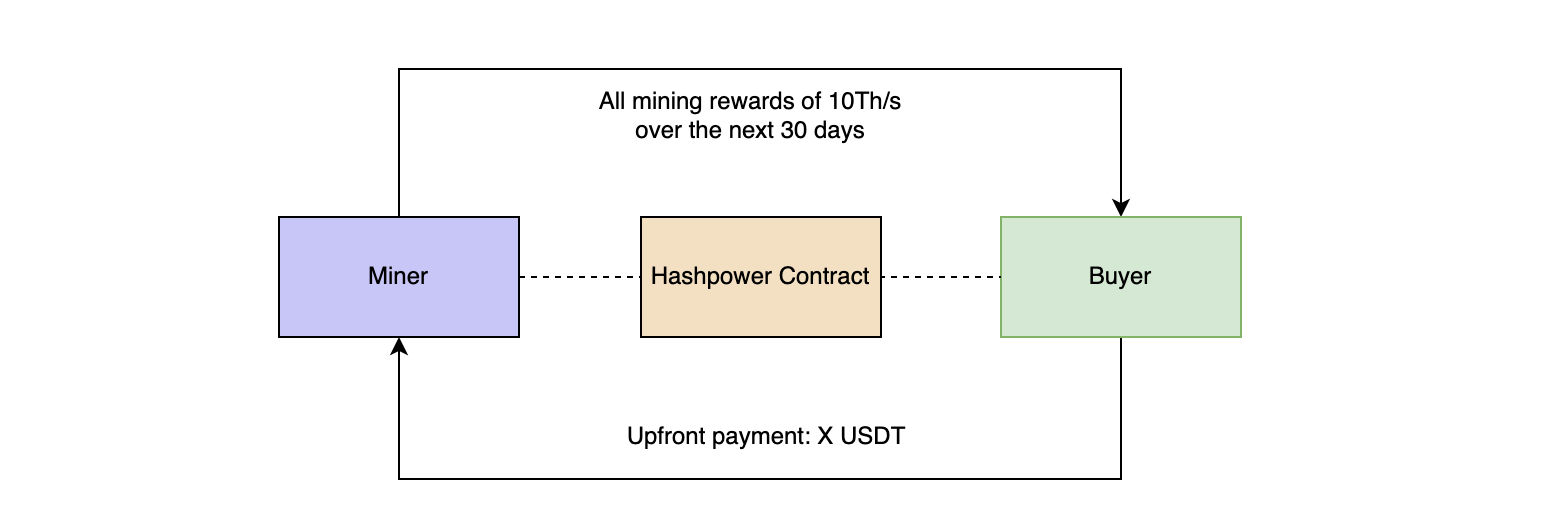

The first part is a permissionless, non-custodial protocol that enables miners to sell their hashpower through a bilateral contract.

The second part is structured products engine, where users can restructure the bilateral contracts into other forms of yield generating assets backed by the cash flow (e.g. fixed-income bonds, convertibles, perpetual swap, DAO payouts).

Unlike most yield generating products collateralized by coins, the cash flow of these assets is secured by the underlying hashpower, which represents the economic activities accrued on the blockchain.

Hashpower Contracts

Miners can sell hashpower as a swap to lock in an upfront payment for their hashrate over a period of time, or can sell call options to enhance the yield on their rewards.

In bear markets, miners can hedge against downside risk by locking in an upfront profit to cover the monthly operating expenses. In bull markets, demand for spot hashpower is insanely high. Miners can take advantage of the high premium.

Miners can interact with Alkimiya via a mining pool they are already mining with. The contracts miners issue are purely financial. Alkimiya only redirects the reward address instead of the physical hashpower, it is extremely easy for miners to onboard without installing additional software or migrating to new platforms.

Any miner is able to join and leave this market at will. Any miner should be able to easily switch between mining for themselves vs. selling hashrate on the market without friction.

Alkimiya achieves this by balancing the economic incentives of miners and buyers. The detailed issuance mechanics and calculations can be found in Documentations.

Hashpower Structured Products

The ownership of the contracts is represented by temporary tokens (Silica) that will be burnt upon default or redemption. These tokens can be broken down into smaller fractions and transacted on secondary markets. Anyone with the tokens can claim the mining rewards associated with the contract when the contract expires.

By treating the financial return of mining as cash flow modules in the form of tokens, users can use them to create different flavors of cash flow generating assets.

For instance, a series of hashpower swap contracts that deliver the rewards of various amounts of hashrate over different periods of time can be bundled up together and reissued as new instruments: a 5% fixed-income bond + an on-chain DAO that continuously reinvests the rewards into new contracts. The payouts of these new instruments come from the bundle of mining rewards.

Alkimiya allows users to freely design and spin up these “structured product engines” —fixed-income bonds secured by hashpower, convertible bonds with mining revenue as underlying, hashpower perpetual swaps, structured products that separate block subsidy and MEV incomes, on-chain mining funds operated by DAOs.

The possibilities are endless.

These assets can be traded on other decentralized exchanges and integrated with the broader DeFi ecosystem. Instead of harvesting yields from instruments dependent on volatile collateral value or lending activities, the cash flow comes from the economic activity that sustains the blockchain itself.

It forms a closed loop, and introduces a new category of much more “hardened” instruments to the DeFi universe.

When the demand for these hashpower-backed assets increases, the demand for base layer hashpower contracts is also indirectly spurred. This is how we scale up the demand.

Roadmap, future work & research

Alkimiya is currently in private beta for selected Ethereum miners. We are starting with Ethereum mining first and will gradually support other PoW coins with functional wrapped ERC20s. We are targeting Q4 2021 to release the full codebase to the public.

Future work & research:

Oracle decentralization: Alkimiya oracle is a federated network of nodes that pulls hashrate and reward data from mining pools. We are looking at ways to improve data granularity and possible ways to reduce the trust in pools.

BTC native solutions: Alkimiya protocol is built on Ethereum as a proof-of-concept. Our primary goal has always been creating something useful for Bitcoin miners. We are actively researching BTC native solutions that let us port the system over and service Bitcoin miners directly.

Moving beyond PoW: The structured product engines can deconstruct and restructure anything that produces a cash flow. The underlying contracts don’t necessarily have to be based on mining returns. We are looking at ways to incorporate staking derivatives as well.

We are actively looking for mining pools to partner with us to make the user-experience more smooth. If you are a pool operator interested in working with us, or curious to learn more, please:

Email us: info@alkimiya.io

Join our Discord: Channel

Sign-up for early access: www.alkimiya.io

We are also looking for like-minded people to join our effort. If you find what we are working interesting. Please don’t hesitate to reach out.

Acknowledgements

We are grateful for our early supporters and investors:

Dragonfly Capital Partners, General Mining Research, Castle Island Ventures, Robot Ventures, and Derek Hsue.

Further Readings

[1] Bitcoin Mining’s Three Body Problem

[2] Ethereum Blockspace: Who Gets What and Why

[3] The Alchemy of Hashpower, Part II.

[4] The Intelligent Bitcoin Miner, Part II.